![]() Download PDF Version | View documents on Sedar

Download PDF Version | View documents on Sedar

- Lemare spodumene pegmatite extended by 250 m

- SW Extension returns wide intercepts of spodumene mineralisation:

-

- 33.7 m @ 0.94% Li2O

- 18.0 m @ 2.00% Li2O

August 17, 2017 – Montreal, Quebec – Critical Elements Corporation (“Critical Elements” or the “Company”) (TSX-V: CRE) (US OTCQX: CRECF) (FSE: F12) and Lepidico Ltd (ASX: LPD) (“Lepidico”) are pleased to advise of results of the second stage of drilling at the Lemare spodumene project in Quebec, Canada.

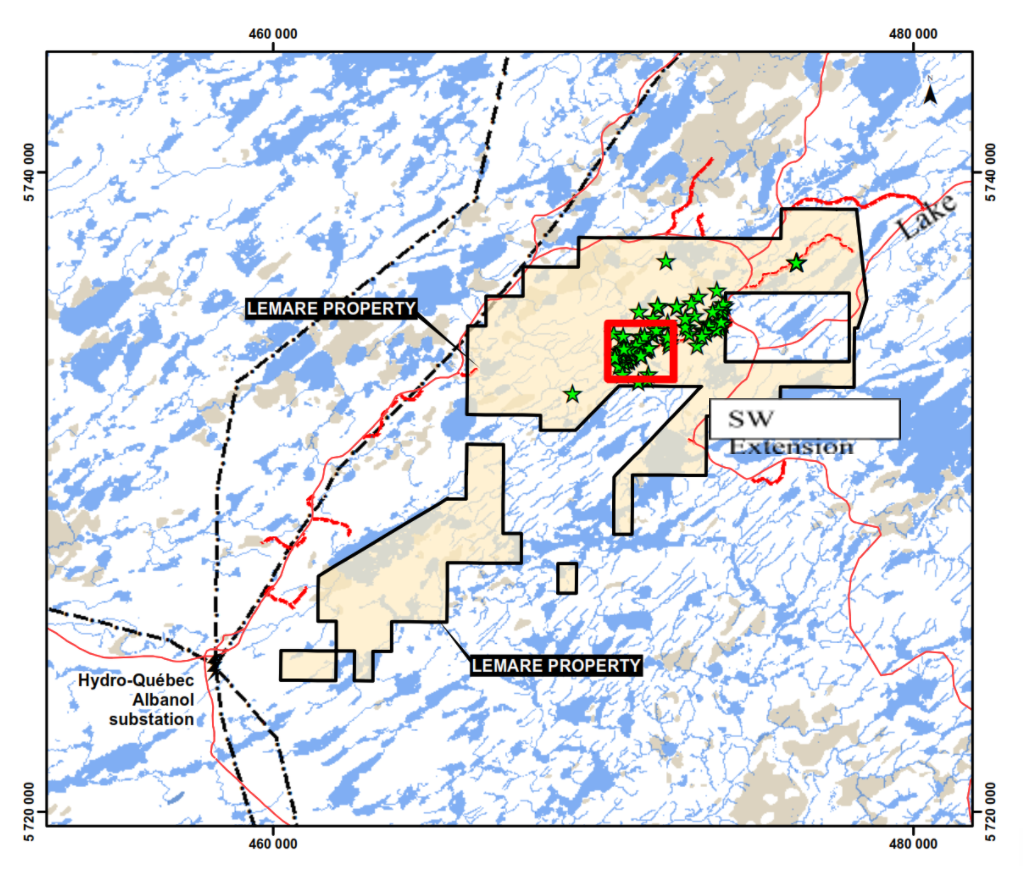

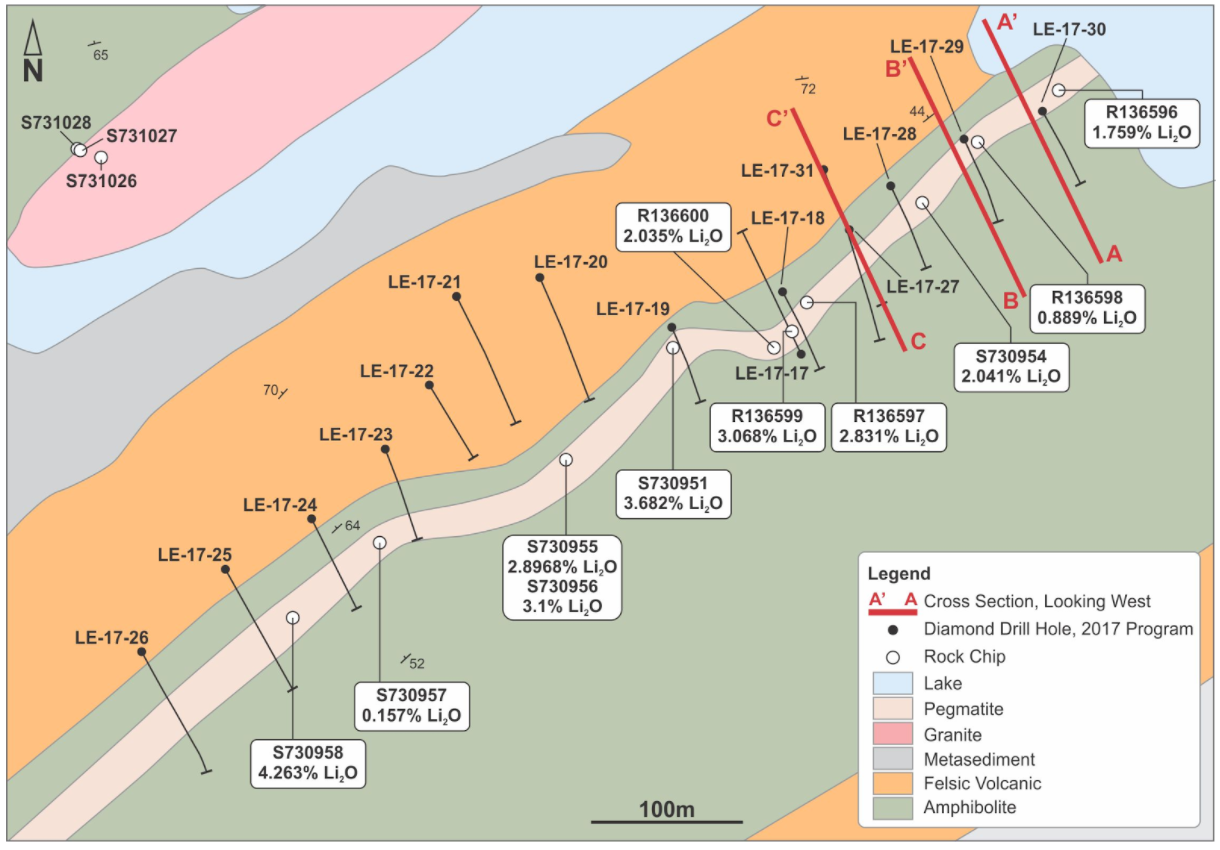

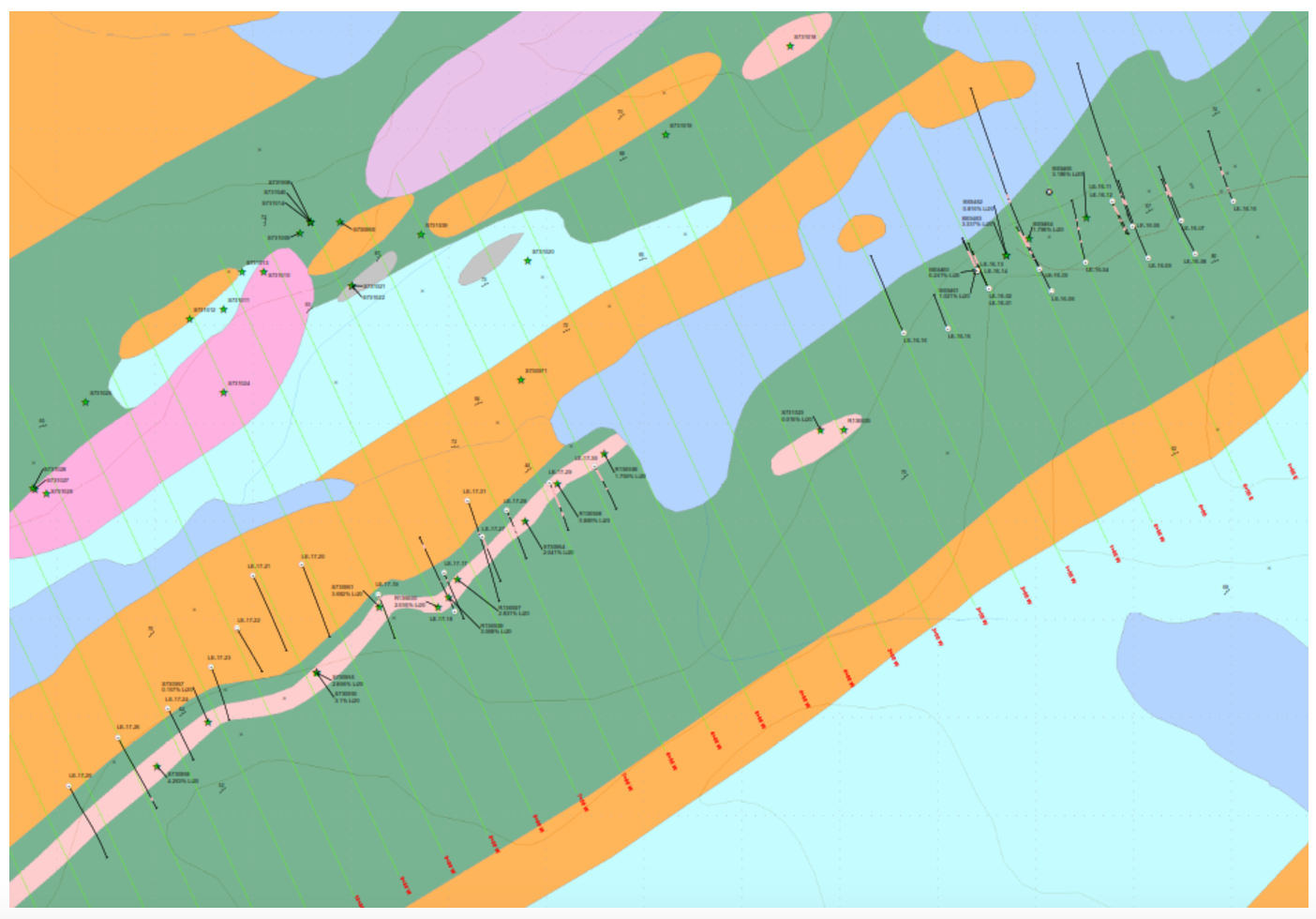

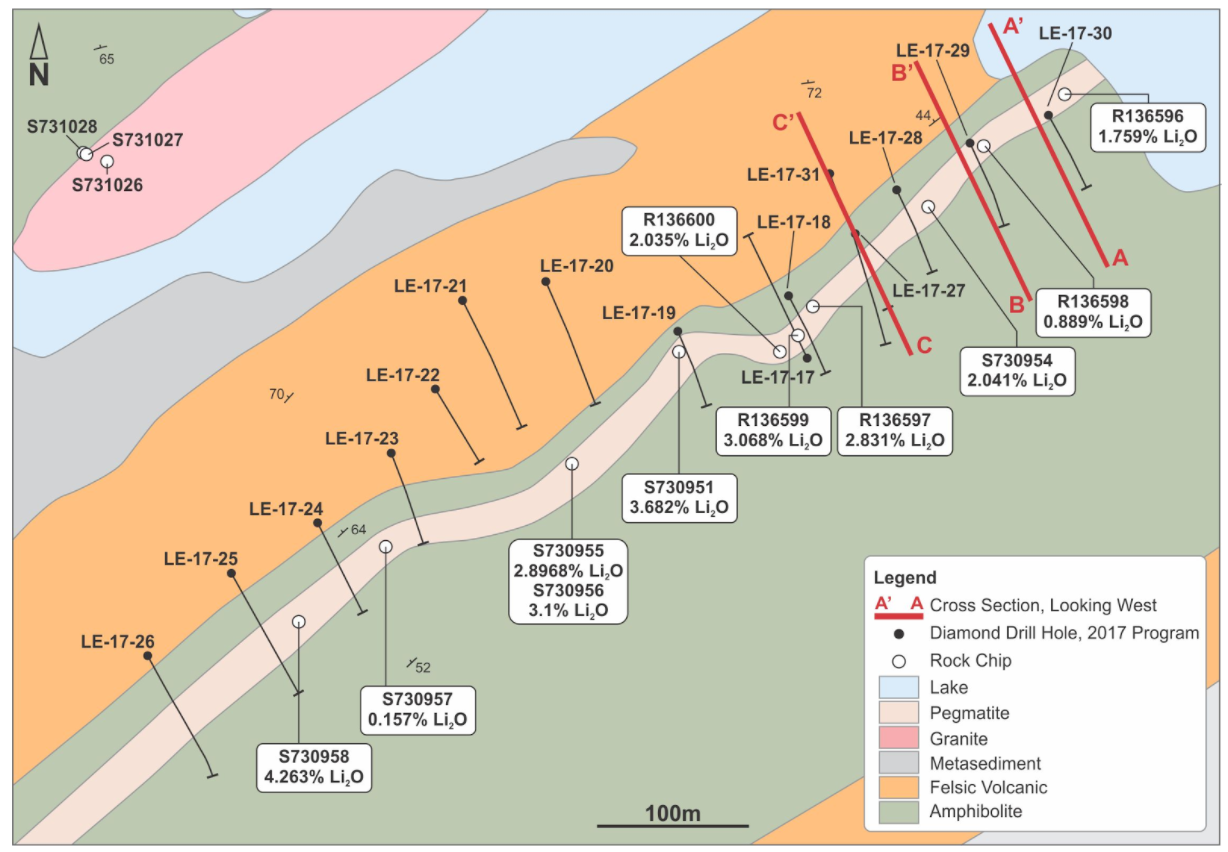

The Stage 2 diamond drilling program was completed along the 600 metre long SW Extension of the Lemare spodumene pegmatite, following on from the Stage 1 drilling in 2016 over the main Lemare prospect. A lake covers the intervening 300 metres between the two prospects (Figures 1 -3).

A total of 15 holes, for 1,527 m of NQ core, were drilled on nominal 50 m sections along the 600 m long extension of the spodumene-bearing pegmatite corridor to the SW of the lake.

A number of wide intercepts were returned, confirming Lemare as a significant spodumene prospect. Better results from the SW Extension include:

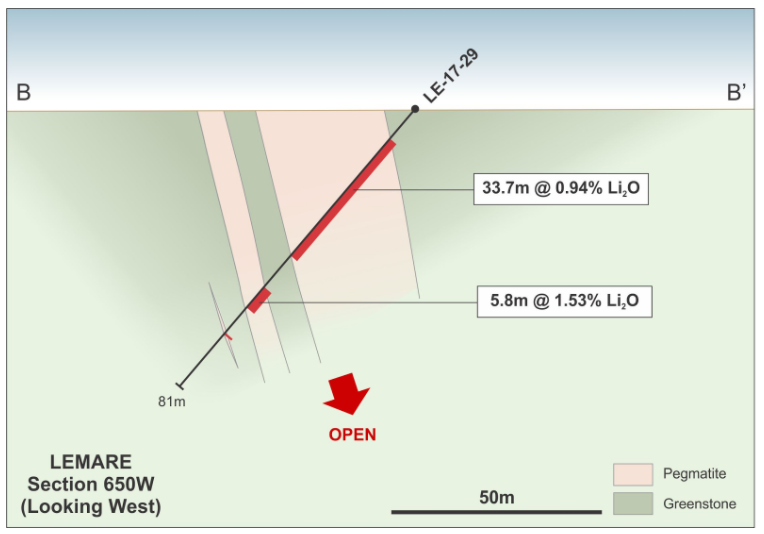

33.7 m @ 0.94% Li2O, from 9.60 m, in hole LE-17-29

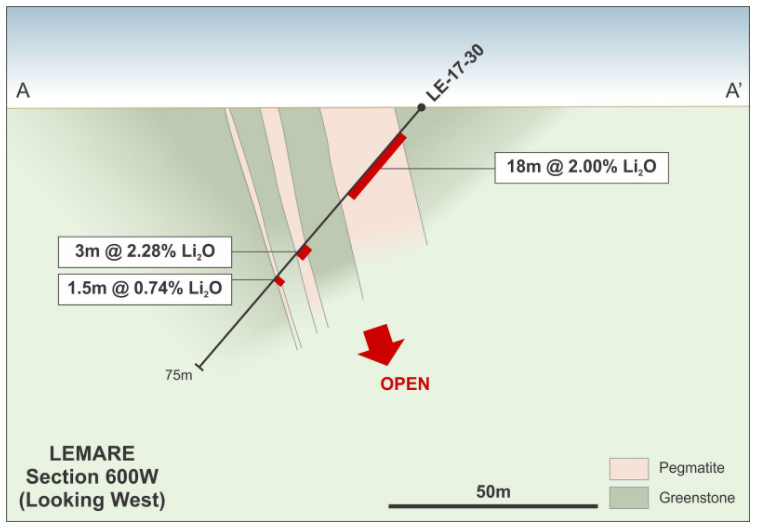

18.0 m @ 2.00% Li2O, from 6.80 m, in hole LE-17-30

These results build on the spodumene mineralisation identified by last year’s drilling at the main Lemare prospect, as reported on November 24, 2016, that included:

28.5 m @ 2.15% Li2O, from 5.50 m, in hole LE-16-13

24.0 m @ 1.87% Li2O, from 13.5 m, in hole LE-16-14

21.0 m @ 1.75% Li2O, from 38.8 m, in hole LE-16-03

A full list of significant intercepts (>0.5% Li2O) from the SW Extension program is presented in Table 1.

Good widths of spodumene-bearing pegmatite are recorded in the eastern 250 m section of the corridor, and remain open at depth, as shown in Figures 4, 5 and 6. Geological logs show spodumene content ranging from 5% up to 25%.

Results from drilling to the west of a sharp inflection in the interpreted position of the corridor, spodumene pegmatites thin or were not intersected at depth by the drilling. This is similar to the pinch-and-swell character of the pegmatites seen at the main Lemare prospect 300 m to the northeast across the lake.

The Lemare spodumene project is some 70 km2 in area and is secured by the Lemare Option Agreement between the Company and Platypus Minerals Ltd.

Under the terms of the Lemare Option Agreement, Lepidico Ltd is earning up to a 75% interest in the Lemare project. To maintain its position, Lepidico Ltd has an initial requirement to spend C$800,000 on exploration by August 31, 2017 (extended from December 31, 2016 by agreement). With completion of the Stage 2 drilling program Lepidico has met this expenditure requirement.

The Companies are pleased by the strong results generated from Lemare to date, which show Lemare to be a promising target with prospectivity for a significant spodumene resource.

To complete the earn of an initial 50% interest in the project, Lepidico is to fund C$1.2M of exploration and delineate a JORC Code compliant Minerals Resource by August 31, 2018. Lepidico can earn a further 25% interest by completing a feasibility study and an environmental study on Lemare by June 30, 2020 and by making a payment of C$2.5M (in cash or shares) to Critical Elements.

Table 1. Lemare Spodumene Project, diamond drilling significant intersections (>0.5% Li2O) from the SW Extension (June 2017) and Lemare (October 2016)

| Lemare Hole Id | From (m) | To (m) | Down-hole Intercept (m) | Li2O (>0.5%)1 |

|---|---|---|---|---|

| SW Extension, 2017 | ||||

| LE-17-17 | 109.7 | 111.80 | 2.10 | 2.37 |

| LE-17-18 | 11.50 | 14.80 | 3.30 | 1.90 |

| 25.30 | 26.80 | 1.50 | 0.83 | |

| LE-17-19 | 3.00 | 6.80 | 3.80 | 1.09 |

| 11.70 | 13.20 | 1.50 | 1.02 | |

| 32.70 | 33.80 | 1.10 | 0.72 | |

| 46.10 | 47.10 | 1.00 | 1.88 | |

| LE-17-27 | 13.30 | 18.30 | 5.00 | 1.58 |

| 19.10 | 21.50 | 2.40 | 0.84 | |

| 25.00 | 25.70 | 0.70 | 0.52 | |

| 27.80 | 28.50 | 0.70 | 1.11 | |

| 33.20 | 36.60 | 3.40 | 1.86 | |

| LE-17-28 | 22.50 | 24.00 | 1.50 | 1.24 |

| 30.00 | 37.30 | 7.30 | 1.18 | |

| 40.90 | 47.00 | 6.10 | 2.26 | |

| 51.30 | 52.80 | 1.50 | 1.21 | |

| LE-17-29 | 9.60 | 43.30 | 33.70 | 0.94 |

| including | 17.70 | 30.70 | 13.00 | 1.42 |

| and | 37.90 | 43.30 | 5.40 | 1.44 |

| 52.30 | 58.10 | 5.80 | 1.53 | |

| LE-17-30 | 6.80 | 24.80 | 18.00 | 2.00 |

| 39.30 | 42.30 | 3.00 | 2.28 | |

| LE-17-31 | 62.00 | 63.00 | 1.00 | 1.90 |

| 71.70 | 73.00 | 1.30 | 1.23 | |

| Lemare, 20162 | ||||

| LE-16-01 | 40.70 | 56.60 | 15.90 | 1.26 |

| LE-16-03 | 38.80 | 59.80 | 21.00 | 1.75 |

| LE-16-04 | 29.30 | 32.30 | 3.00 | 0.96 |

| 62.30 | 63.30 | 1.00 | 1.23 | |

| LE-16-05 | 35.20 | 40.50 | 5.30 | 1.79 |

| 46.00 | 47.75 | 1.75 | 2.28 | |

| LE-16-06 | 73.90 | 76.25 | 2.35 | 1.92 |

| LE-16-07 | 36.00 | 51.00 | 15.00 | 1.62 |

| LE-16-09 | 83.35 | 85.85 | 2.50 | 1.01 |

| 91.25 | 92.85 | 1.60 | 1.43 | |

| LE-16-11 | 9.50 | 10.50 | 1.00 | 1.26 |

| LE-16-12 | 15.00 | 17.50 | 2.50 | 1.23 |

| 24.50 | 32.90 | 8.40 | 1.43 | |

| LE-16-13 | 5.50 | 34.00 | 28.50 | 2.16 |

| LE-16-14 | 13.50 | 37.50 | 24.00 | 1.87 |

| 42.00 | 51.00 | 9.00 | 2.70 | |

Notes:

1) Li2O derived by multiplying elemental Li assay by conversion factor of 2.153

2) Lemare drilling reported to ASX on November 24, 2016 (under ASX code PLP).

About Critical Elements Corporation

A recent financial analysis (Technical Report and Preliminary Economic Assessment (PEA) on the Rose lithium-tantalum Project, Genivar, December 2011) of the Rose project, 100% owned by Critical Elements, based on price forecasts of US $260/kg ($118/lb) for Ta2O5 contained in a tantalite concentrate and US $6,000/t for lithium carbonate (Li2CO3) showed an estimated after-tax Internal Rate of Return (IRR) of 25% for the Rose project, with an estimated Net Present Value (NPV) of CA $279 million at an 8% discount rate. The payback period is estimated at 4.1 years. The pre-tax IRR is estimated at 33% and the NPV at CA $488 million at a discount rate of 8%. (Mineral resources are not mineral reserves and do not have demonstrated economic viability). (The preliminary economic assessment is preliminary in nature). (See press release dated November 21, 2011.) The PEA includes inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves and there is no certainty that the preliminary economic assessment will be realized.

The conclusions of the PEA indicate that the operation would support a production rate of 26,606 tons of high purity (99.9% battery grade) Li2CO3 and 206,670 pounds of Ta2O5 per year over a 17-year mine life.

The project hosts a current Indicated resource of 26.5 million tonnes of 1.30% Li2O Eq. or 0.98% Li2O and 163 ppm Ta2O5 and an Inferred resource of 10.7 million tonnes of 1.14% Li2O Eq. or 0.86% Li2O and 145 ppm Ta2O5.

FOR MORE INFORMATION:

Jean-Sébastien Lavallée, P.Geo.

Chairman and Chief Executive Officer

819-354-5146

www.cecorp.ca

Investor Relations:

Paradox Public Relations

514-341-0408

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.