August 8, 2016 – Montreal, Quebec – Critical Elements Corporation (the “Corporation” or “Critical Elements”) (TSX-V: CRE) (US OTCQX: CRECF) (FSE: F12) is pleased to report the results of sampling on a pegmatite south of the Helico showing (Table 1). The samples were collected while the camp was being upgraded for future work as part of the planned feasibility study and drilling on the Rose tantalum-lithium project.

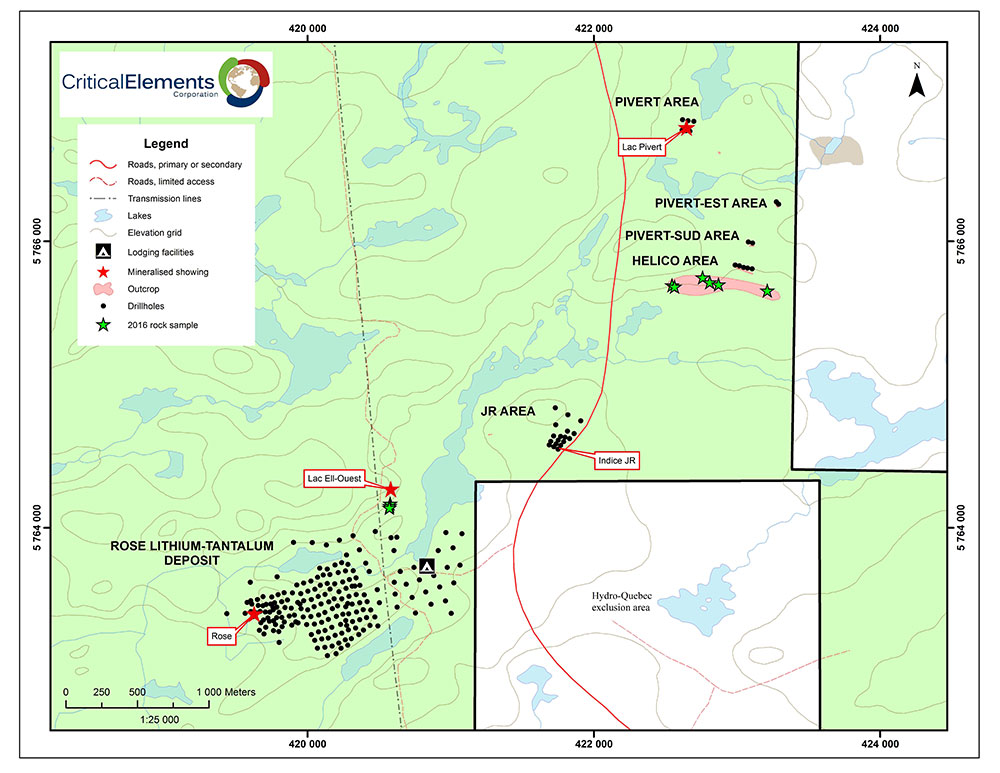

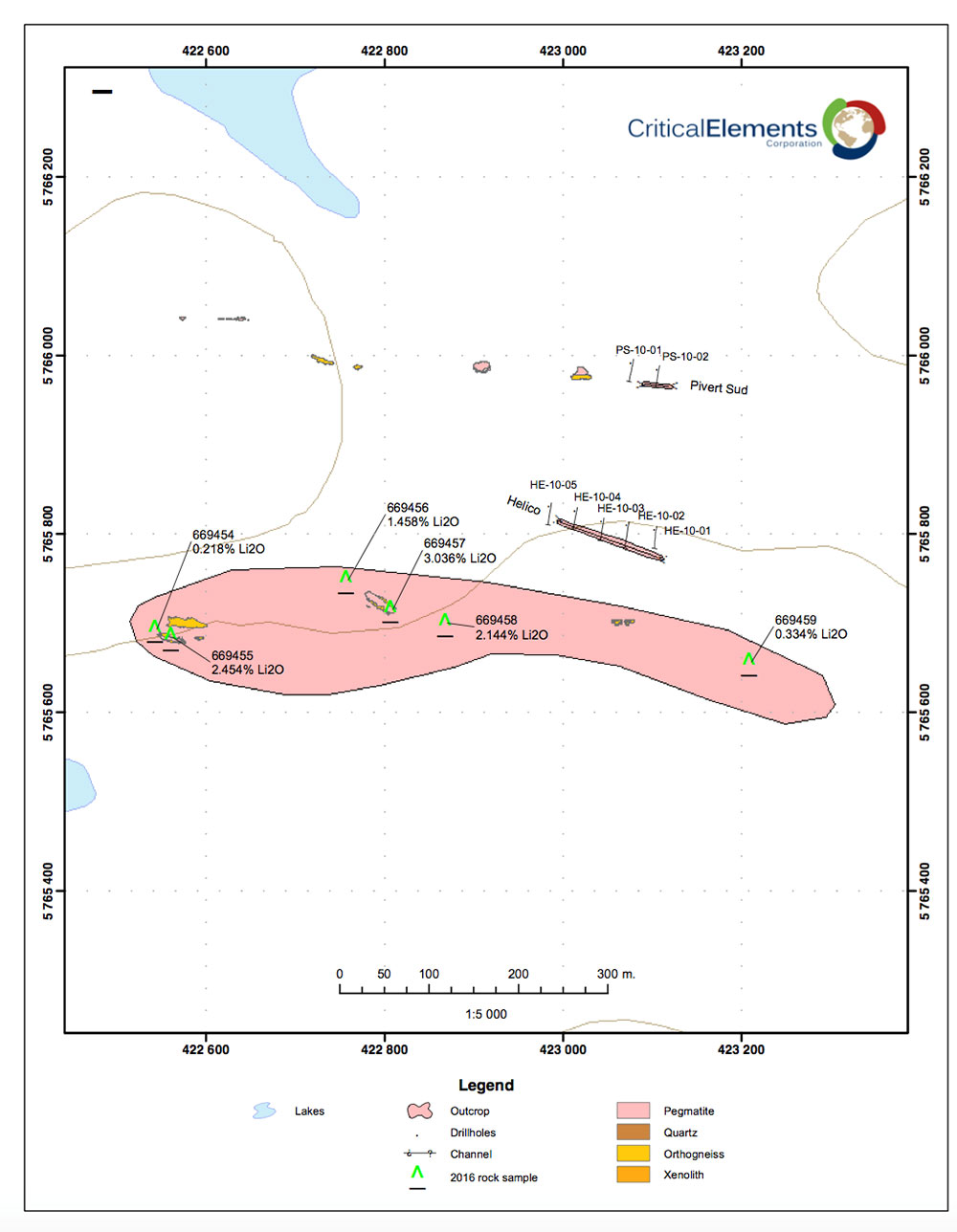

During the upgrade of the Rose lithium-tantalum project camp, a quick visit to two showings located south of the Helico showing (Helico Sud) and south of the Lac Eli-Ouest showing (Lac Eli-Sud) identified high-grade zones within the Helico Sud pegmatite. A total of nine chip samples were collected on the showings in areas of outcropping spodumene pegmatites (Photos 1 and 2). The results confirm high levels of lithium, up to 3.04% Li2O and 248 ppm Ta2O5, at Helico Sud. The location of the Helico Sud showing is shown on the map below (Figure 1 and 2).

Table 1. Results for Chip Samples from the Helico Sud and Lac Eli-Ouest-Sud1 Showings, July 2016

| Year | Area | Sample No. | Easting | Northing | Li20 (%) | Ta2O5 ppm (g/t) |

|---|---|---|---|---|---|---|

| 2016 | Lac Eli-Ouest | 669451 | 420577 | 5764168 | 0.01 | 89 |

| 2016 | Lac Eli-Ouest | 669452 | 420574 | 5764152 | 0.02 | 117 |

| 2016 | Lac Eli-Ouest | 669453 | 420572 | 5764140 | 0.01 | 93 |

| 2016 | Helico Sud | 669454 | 422545 | 5765693 | 0.22 | 72 |

| 2016 | Helico Sud | 669455 | 422563 | 5765684 | 2.45 | 92 |

| 2016 | Helico Sud | 669456 | 422759 | 5765748 | 1.46 | 118 |

| 2016 | Helico Sud | 669457 | 422809 | 5765715 | 3.04 | 173 |

| 2016 | Helico Sud | 669458 | 422870 | 5765700 | 2.14 | 150 |

| 2016 | Helico Sud | 669459 | 423211 | 5765656 | 0.33 | 248 |

1 Chip samples are selective by nature, and cannot be considered representative of the mineralization

Photo 1. Pegmatite outcrop and the Helico Sud showing

Photo 2. Close-up photo of the Helico-Sud pegmatite showing large spudomene crystals, as well as sample 669456

Figure 1. Location map of the various showings on the Rose lithium-tantalum project

Figure 2. Location map of the grab samples from Helico-South

Given these very promising results, Critical Elements has decided to prepare an exploration drilling program for September, including drilling on the Helico Sud sector, the JR showing and other spodumene pegmatites identified during previous work in the Pivert sector. The exploration drilling program will also include condemnation drilling to test for possible resources at the planned site of the various Rose lithium-tantalum project installations.

“These results are not only positive for the Corporation, they also once again demonstrate the quality and strong discovery potential on the Rose lithium-tantalum project for new near-surface lithium mineralized zones that could increase resources and extend the project mine life,” said Jean-Sébastien Lavallée, President and Chief Executive Officer of Critical Elements Corporation. “The coming months will be particularly exciting given the drilling planned on the various project showings and the feasibility study on the Rose lithium-tantalum project.”

Jean-Sébastien Lavallée (OGQ #773), geologist, shareholder and President and Chief Executive Officer of the Company and a Qualified Person under NI 43-101, has reviewed and approved the technical content of this release.

About Critical Elements Corporation

A recent financial analysis (Technical Report and Preliminary Economic Assessment (PEA) on the Rose lithium-tantalum Project, Genivar, December 2011) of the Rose project, 100% owned by Critical Elements, based on price forecasts of US$260/kg ($118/lb) for Ta2O5 contained in a tantalite concentrate and US$6,000/t for lithium carbonate (Li2CO3) showed an estimated after-tax Internal Rate of Return (IRR) of 25% for the Rose project, with an estimated Net Present Value (NPV) of CA$279 million at an 8% discount rate. The payback period is estimated at 4.1 years. The pre-tax IRR is estimated at 33% and the NPV at $488 million at a discount rate of 8%. (Mineral resources are not mineral reserves and do not have demonstrated economic viability). (The preliminary economic assessment is preliminary in nature). (See press release dated November 21, 2011.)

The conclusions of the PEA indicate the operation would support a production rate of 26,606 tons of high purity (99.9% battery grade) Li2CO3 and 206,670 pounds of Ta2O5 per year over a 17-year mine life.

The project hosts a current Indicated resource of 26.5 million tonnes of 1.30% Li2O Eq. or 0.98% Li2O and 163 ppm Ta2O5 and an Inferred resource of 10.7 million tonnes of 1.14% Li2O Eq. or 0.86% Li2O and 145 ppm Ta2O5.

FOR MORE INFORMATION:

Jean-Sébastien Lavallée, P.Geo.

President and Chief Executive Officer

819-354-5146

www.cecorp.ca

Investor Relations:

Paradox Public Relations

514-341-0408

Neither the TSX Venture Exchange nor its Regulation Services Provider

(as that term is defined in the policies of the TSX Venture Exchange)

accepts responsibility for the adequacy or accuracy of this release.